The price of gold has more than tripled since I started my first jewelry business in 2005. If you have questions about why gold costs what it costs, I have answers for you in these posts:

If those posts trigger your tl;dr issues, consider this: I recently made a piece for $2,500. That was the cost to me. Years ago, I SOLD the same piece to a customer for $1,500. That’s not unusual. The costs of producing new versions of old designs regularly exceed my former selling prices. As a result, I do a lot more silver designs than I used to, but I can’t give up gold. It’s still my favorite metal.

Normally, when I want to give myself sticker shock, I check the price of 16 inches of heavy 18K-gold chain that I first used in 2006.

In 2006, the 16 inches of chain — excluding the clasp — cost $255 wholesale. By 2008, it was $444. In 2010, it went up to $530. Last year, it cost about $640.

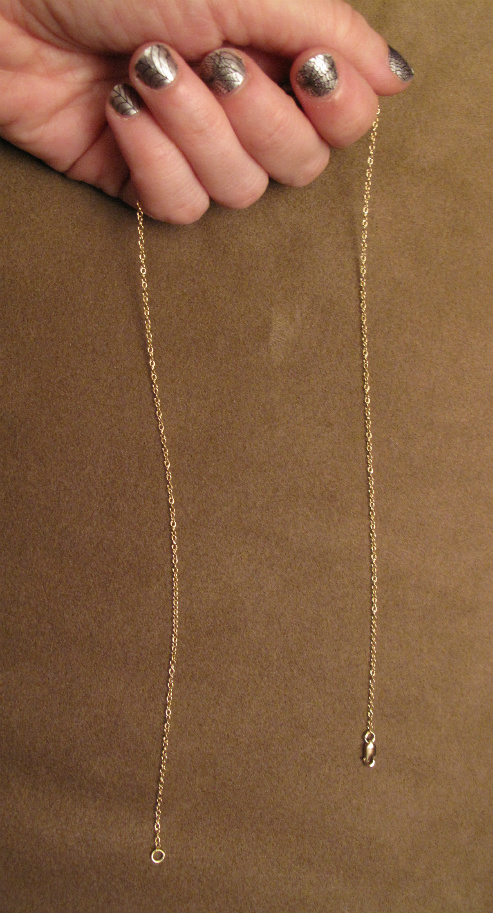

Last week, the cost of gold in market trading hit a 2012 high of nearly $1,800 an ounce (in 2005, as I launched my business, gold’s price per ounce was below $500). I was too busy filling orders for two necklaces to price my usual heavy chain, but I experienced sticker shock anyway, due to this much more delicate 18K-gold chain.

I haven’t been buying this style very long, so I don’t have years of perspective on it, but I was still impressed to pay slightly more than $200 wholesale for 18″ of chain (including clasp, this time). Technically, I should double my costs when selling wholesale to a store. The store then — at a minimum — doubles the wholesale price to cover all of its costs and make a profit when it sells to you, the retail customer. What does that mean? That this chain and clasp should cost $800 in a store, just for what you see above — a generic chain with no pendant or other design element.

In reality, I don’t mark up my costs for findings — chains, clasps and jump rings — like I should, because the ultimate retail price would be unreasonable. Sometimes I even pass along the original cost of such parts to y’all. It’s not ideal. Obviously, a business that doesn’t make enough of a profit is eventually no longer a going concern. But like a lot of jewelers I know, I’m absorbing more expenses than I should while trying to raise my profile to the point where I get the orders that will allow me to produce my designs in quantity. Making more pieces at once lowers my costs, which enables me to raise my profit margins.

In the meantime, you’re getting a better deal than you might realize on some of my most expensive work, especially when you shop my sale here. For more information on costs and how they’re affected by quantity (aka “economy of scale”), click here.

I snicked in under the wire, I guess. 😉

I keep thinking the price of gold has to drop, but it may take awhile.

Your sales are the best :).

This is scary. No wonder my anti-spam word is DISTURBIA! I mean, how much higher can it go?

People have been predicting it breaking $2,000 an ounce for years now. Lately they’re like, “No, this time it’s really going to happen.” I hope they’re wrong …again!

The hurdles of finding the good price. With my new biz, I’m getting used to that part.

Doesn’t matter what industry you’re in — it’s a challenge for all small businesses!

Love the nails!

These posts are so interesting – thanks, WendyB!